This article is more than 1 year old

Good from AFA... and not far from good: Analysts reveal flash array vendors' digits

For now, it's a business to be in... for everyone but Hitachi

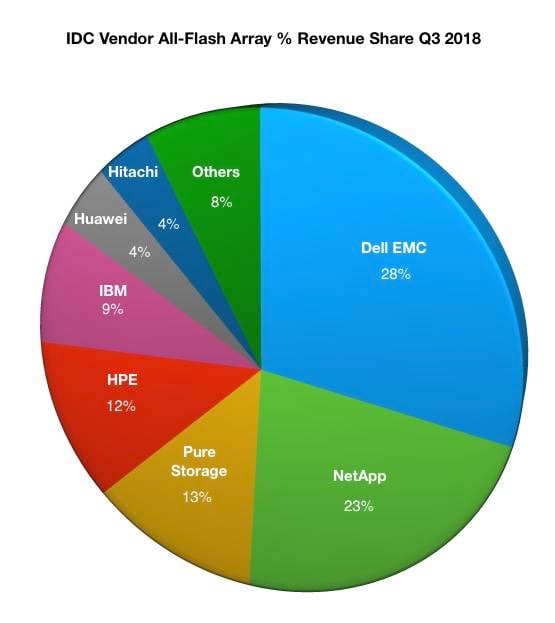

IDC numbers show Dell EMC's position at the top of the all-flash array (AFA) market weakened as it grew less than the market as a whole, giving chasing vendors hope – except Hitachi, which managed to fall back despite a growing market.

The analyst said that AFA slingers collectively generated just over $2.15bn in revenue during the quarter, up 39.3 per cent year over year.

Detailed AFA numbers from IDC's Storage Tracker for 2018's third quarter and Wells Fargo Securities revealed the vendor reality:

| Vendors | Q3 '17 revenue | Q3 '18 revenue | Per cent Change |

| Dell EMC | $487.8m | $608.5m | 24.7 |

| NetApp | $328.8m | $491.2m | 49.4 |

| Pure Storage | $199.1m | $270.0m | 35.6 |

| HPE | $175.4m | $255.8m | 45.8 |

| IBM | $140.0m | $188.7m | 34.8 |

| Huawei | $20.6m | $96.9m | 370.6 |

| Hitachi | $92.3m | $85.6m | -7.1 |

| Others | $105.7m | $162.3m | 53.6 |

As far as shifting arrays, Dell EMC leads, but its growth was lower than that of NetApp, Pure Storage, HPE, IBM or Huawei. It had the leading share a year ago and has retained it. Last-placed Hitachi has fallen back badly - the only vendor with shrinking revenues, and been overtaken by Huawei. The market grew 39.3 per cent – so Hitachi's not the only that didn't keep pace with that growth: IBM, Pure and Dell EMC also failed to keep in step.

NetApp increased revenues faster than everyone else, except Huawei, which is growing from a small base.

Dell EMC benefited from having four product lines which all grew: VMAX, Unity, Xtremio and Isilon.

| Q3 2017 | Q3 2018 | Percent Change | |

| VMAX | $212.3m | $270.5m | 27.4 |

| Unity | $200.0m | $241.0m | 20.5 |

| XtremIO | $70.3m | $79.1m | 12.4 |

| Isilon | $5.1m | $17.9m | 251.0 |

NetApp had a knockout success with its A Series, where revenues grew 75 per cent year-on-year to $430.9m, with SolidFire and the EF Series trailing with 28.2 and 24.3 per cent growth respectively to $30.1m and $14.1m.

Its all-flash FAS, succeeded by the A-Series, fell back from $47.8m a year ago to $16.1m, down 66.3 per cent.

Pure saw its FlashArray//x grow revenues from $2.1m a year ago to $201.1m while the previous FlashArray//m product saw revenues decline 89.5 per cent from $184.2m to $19.3m. Its FlashBlade array revenues rose 286.7 per cent from $12.8m a year ago to $49.6m.

Both the 3PAR and Nimble AFA products grew for HPE: 3PAR at 54.7 per cent to $202.6m and Nimble 19.5 per cent to $53.1m. HPE all-flash revenues are close to those of Pure, and growing faster: 45.8 per cent versus 35.6 per cent.

Individual IBM product line numbers are not available.

Overall the relative vendor positions are stable, with solid customer take-up of all-flash products. It's worth noting that, by way of comparison, the hybrid flash array market is still worth more – it chalked up just over $2.6bn for the quarter compared with AFA market's $2.15bn. However, the hybrid slingers' sales only grew 16 per cent year on year as opposed to the all-flash crowd's 39.3. ®