This article is more than 1 year old

Will rush for New Radio compromise 5G quality?

Accusations fly of vendors hijacking standards for their own purposes

Analysis The US operators have ended their long love affair with sub-1 GHz spectrum, which was so important to their LTE coverage roll-outs, and are leading the world in harnessing high frequency bands to address the challenge of the expected capacity demands of the 5G era.

While regulators and operators in some areas – many in Europe, for instance – see the centimeter and millimeter wave bands as a second phase, adding targeted dense capacity after a more conventional sub-6 GHz network has been built out, the US carriers are impatient to start using the underpopulated high frequency bands.

AT&T and Verizon see the tactical opportunity to extend their fixed broadband footprints using cost-effective wireless, and since this use case does not involve the challenges of device availability and roaming, it can be pursued even in advance of official standards (which has led to an ongoing spat between the two operators about whether they are steering the 5G process off on a semi-proprietary diversion). Of course, there are significant challenges to running commercial broadband wireless in these high bands.

WiGig, the Wi-Fi-like technology in 60 GHz, has addressed some of the issues during its decade of gestation, including the ability to deliver the modem chips in CMOS, which was previously very difficult, hitting the economics of the mass market. Other issues, like the best air interface for a cellular system in millimetre wave bands, and the optimal way to get round the range and penetration limitations, are still up for debate.

Qualcomm’s 28 GHz modem

Qualcomm will naturally aim to be in the forefront of defining standards for this area, especially if the 3GPP opts for a brand new air interface – many believe the OFDM*-based options which are likely to prevail as successors to the LTE design in sub-6 GHz spectrum will be sub-optimal in high bands. The San Diego chip giant will need to establish its customary IPR position, and design leadership, in order to bolster its pressurized mobile broadband business case into the 5G age.

This week, in a slew of LTE-Advanced and pre-5G announcements, Qualcomm announced plans for a 28 GHz modem that will be used in separate pre-standard 5G trials by Verizon (which is pursuing its own approach to a New Radio with a group of suppliers) and Korea Telecom (KT).

The experimental Snapdragon X50 delivers peak performance of 5Gbps on the downlink, and “multiple gigabit uplinks for mobile and fixed wireless networks”, said the vendor. It is designed to work alongside an LTE network, which not only places the technology firmly in the hands of existing mobile operators, but also means carriers do not have to attempt the impossible – achieving significant coverage with a high frequency spectrum.

This design uses a separate LTE connection as an anchor for control signals, in an approach somewhat linked to that established in the 3GPP for LTE-LAA, which has an anchor LTE network in licensed airwaves and a supplemental, high speed link in unlicensed bands. That anchor approach will be the basis of the first phase of 3GPP 5G specifications, before a fully independent platform is standardised.

With the X50, the 28 GHz link delivers the higher data rates over distances of tens to hundreds of meters. The modem uses an 800 MHz channel, a 2x2 MIMO antenna array, adaptive beamforming techniques and 256 QAM modulation to achieve a 90 dB link budget. It works in conjunction with Qualcomm’s SDR05x transceiver for millimetre wave spectrum and its PMX50 power management chip.

Operators pile on pressure for faster progress

More details will follow, and the chip will sample next year and be in production before June 2018. Both Verizon and KT plan to use it in trials starting from late 2017, with a view to launching commercial services in 2018. Verizon’s will focus on fixed wireless while KT plans a mobile "5G" service at the Winter Olympics in February 2018. In February, these two operators, plus two other front-runners, NTT Docomo of Japan and SK Telecom of Korea, agreed to share the results of their early trials of 5G architectures. This is a familiar pattern for Qualcomm – it has already been involved in numerous pre-standard 5G tests and demonstrations using non-commercial prototypes, and now it has unleashed a commercial-class chip well ahead of rivals, giving itself a clear headstart whenever the market becomes real.

All these operator-driven, pre-standard activities put pressure on the official standards process to speed up, or risk seeing firstphase 5G splintering into several semi-proprietary or de facto standard platforms. That would have a severe impact on the availability of standardized, affordable equipment and devices for the great majority of MNOs which are not at the cutting edge of 5G deployment, and could actually delay deployment for them even while the exclusive club of trailblazers was able to move more quickly. There are risks for those early movers too – they will no doubt remember the challenges which NTT Docomo faced in bringing its pre-standard FOMA implementation of 3G into line with the world.

As in high frequency spectrum, there are lessons to be learned from the Wi-Fi community. This has faced the same tension between the market push to accelerate progress on next generation equipment, and the need to follow clear standards body processes in order to ensure a quality result which is properly tested and approved by a wide range of players. In Wi-Fi, the certification role of the WiFi Alliance has largely created a successful compromise. The Alliance can push extensions to the platform more quickly than the IEEE, and has the support of virtually the whole industry, so there are far fewer proprietary distractions – and eventually, Alliance-initiated specifications are incorporated into official 802.11 standards.

A two-way process of this kind is needed in the cellular world, with greater cooperation between companies seeking a pre-standard approach, and some systems of certification for widely adopted technologies and interfaces, even before they are submitted to 3GPP or ETSI.

The 3GPP is certainly feeling the pressure. Last month it supported a proposal to consider moving the date for finishing Phase I of its specs, which will deliver an initial version of 5G anchored to LTE, from June 2018 to as early as December 2017. That anchor approach, in itself, gives 4G operators tools to move ahead with 5G at an earlier stage than was originally envisaged.

“We are looking to accelerate the standards effort with key decisions coming in the next quarter or two,” wrote Peter Carson, a director of product marketing at Qualcomm, in a blog post. “Early trials will help accelerate the learning curve…trying to implement in real commercial form factors now will help accelerate [an understanding of the] trade-offs.”

However, others believe the 3GPP is being bulldozed into an overhasty process which may compromise on quality and innovation, and will not have time to understand issues like new test techniques fully. One engineer who takes part in 3GPP meetings told EETimes: “There are several powerful operators and vendors who have a primary goal of expediting 5G at the cost of much innovation in Phase I.”

Two-phase process raises concerns

This may lead to some vendors and operators – and any new entrants without LTE anchor networks – to focus their efforts and business plans on Phase II, which will take a far broader view, including 5G’s much-vaunted optimized support for non-mobile broadband use cases in the Internet of Things and Tactile Internet; and also focusing on the high frequency bands from 40 GHz to 100 GHz.

This suggests that initial "5G" roll-outs will actually be like initial 3G and 4G roll-outs – based on the most basic interpretation of the architecture, and coming nowhere near the targeted deliverables of the new standard. But at least these early deployments allow operators to test some aspects of the new platforms, and they can generate an initial revenue flow for MNOs and vendors, which can, in turn, boost the business case for full 5G. This does mean, though, that the most dramatic impacts envisaged for 5G, including most of the IoT use cases such as vehicle-to-vehicle communications, will not appear until the early 2020s, and may risk being pre-empted by technologies from other communities such as unlicensed spectrum or new fixed platforms.

Qualcomm and others insist that bringing Phase I (Release 15) deadlines forward will not affect timescales for Phase II (Release 16), which is expected to be finalized in 2020, with commercial services from 2021 or 2022.

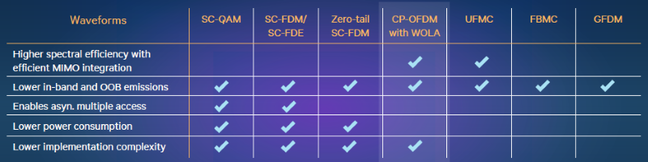

There is a great deal to be agreed if Phase I is to hit its new deadline and provide a reasonably well-rounded, quality spec. There is growing consensus that it will adopt an OFDM-based waveform on both uplink and downlink, rather than LTE’s SC-FDMA uplink, or a new design. But there is no agreement on coding schemes as yet.

Originally, many expected a new waveform to be adopted for high frequency 5G, and that may still occur in Phase II, but there is potential confusion between that optimized approach for millimeter wave, and the fact that some operators will deploy Phase I in bands such as 28 GHz. That uncertainty has led Verizon to develop its own specs for a 5G air interface for 28 GHz, and accusations of hijacking the standards process for its own ends.

Some worry that the shortened timescales for Phase I will lead to compromises. Some operators at the last 3GPP meeting referred to the proposals as “LTE Advanced Pro, Olympics Edition”, reported attendees. But a Qualcomm representative said: “The new 5G air interface will bring both new capabilities, flexibility and efficiency below 6 GHz. Although it is OFDM-based, we would not call it a variant of LTE.”

Air interface and coding choices

The air interface is targeted to be fully agreed by March, and of course, vendors can secure significant IPR and commercial advantage by driving the specs.

Qualcomm is proposing a suite of OFDM techniques to support most 5G use cases except large IoT deployments, which will require something different.

Alan Carlson, European head of InterDigital, a major contributor to 3GPP standards, wrote earlier this year: “Two licensed band cellular definitions are expected below 6 GHz. The second will be especially tailored for IoT support. It is less likely in my opinion that this will be based on OFDM. OFDM is great for video, but in the IoT world of trillions of randomly occurring access events, its strict synchronization needs render a severe handicap.”

Qualcomm agrees with this assessment, and is pitching its nonorthogonal RSMA (resource spread multiple access) technology for IoT transmissions with low data rate and signalling, but high requirement for reliability – while sticking to OFDM elsewhere. A new multiplexing technique would allow traffic requiring very low latency to take priority automatically and to use RSMA. This technology uses time and frequency spreading and overlaps users in a way that aims to improve network efficiency and power consumption. It can support mobility and downlink meshing, as well as network-assisted mesh on the uplink.

John Smee – a senior director of engineering at Qualcomm Research and head of the firm’s 5G technical work – told EETimes: “It’s not a new waveform but an expansion of OFDM for wider use cases with a family of numerologies with scaled tone spacing. No one numerology fits all use cases, but a family of three or four provides a checkerboard of design parameters.” This then allows systems be optimized for different cell sizes and frequency bands, a step towards the infinite flexibility which most envisage for a 5G network which will have to adapt to many different applications and business models, some as-yet undefined.

Qualcomm summarizes this approach as “a unified air interface with optimized OFDM-based waveforms and multiple access, with a flexible framework that can scale from low spectrum bands to mmWave, from macro deployments to local hotspots, and will support licensed, unlicensed, and shared licensed spectrum from the beginning … For targeted use cases such as sporadic uplink traffic from battery-powered IoT sensors, the use of non-orthogonal RSMA helps further reduce device complexity.”

Carson, in his blog, said the process was leveraging experience from LTE-A Pro and 802.11ad (WiGig), in terms of higher bands and large antenna arrays (up to 32 in those standards). He said the 3GPP has narrowed the field to three flavors of OFDM for Phase I with “higher order modulation beyond 256 QAM under consideration”. This is interesting in itself. 256 QAM was originally intended for small cells, but is now being studied for the macro layer too (see separate item). Even higher QAM schemes, such as 1024 QAM, are now being considered for the future evolution of LTE/LTEAdvanced Pro and 5G.

Qualcomm highlighted in a white paper its preferred OFDM variants for a 5G air interface. Image: Qualcomm