This article is more than 1 year old

Australian tech businesses score $940m of VC and private equitty

2013/14 investment falls, so expect whining about steam-powered investors to start in three ... two ...

Startup-land Australia likes nothing more than to whinge about how hard it is for tech companies to find their first investors in Australia. The sector is considered scarcely capable of spelling HTML, never mind capable of understanding its importance enough to invest in someone that wields it.

Complaints about how hard it is to find funds in Australia are therefore a hardy perennial of the business press, along with uncritical calls for Australia to do everything possible to help more tech startups fritter away high-risk capital. For such is the (hoped-against-but-assumed) outcome of most venture capital investments.

Which brings us to 5678.0 - Venture Capital and Later Stage Private Equity, Australia, 2013-14, this year's edition of the Australian Bureau of Statistics' look at just how much cash is splashed around Australia by unconventional and/or highly speculative investors.

The document points out that overall venture capital investment went up from 2012/13's AU$164m to AU$191m in 2013/14.

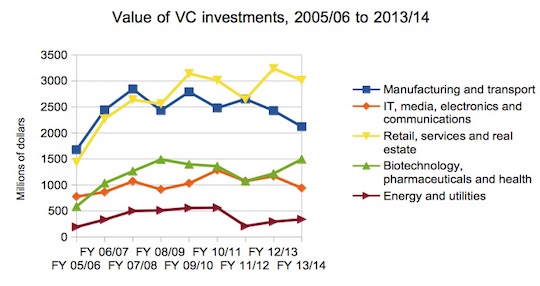

Companies in the field of “IT, media, electronics and communications” did alright, with 162 companies sharing AU$940 million from all sources of funding, which the ABS describes as including pre-seed, seed, startup, early expansion, late expansion, turnaround and three exits - leveraged buyout, IPO or other listing. Or about $5.8m apiece.

The news isn't all good: last year the sector attracted $1.16bn, shared among 185 companies.

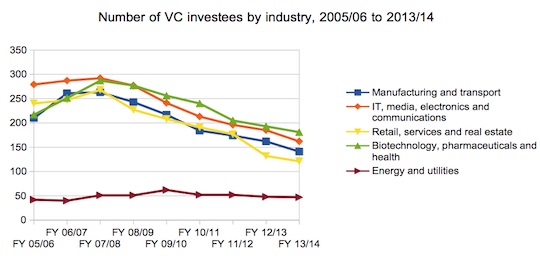

But when one looks at all sectors, it's clear IT's bleeding wasn't horribly worse than that in the other four categories of business the Bureau tracks.

Here's a look at the number of investee companies.

And here's a look at the value of these VC and later stage private equity investments in Australia.

We'll concede that investments in IT, Media, Electronics and Communications didn't go up between 12/13 and 13/14. But the graphs above make it plain that IT wasn't the only sector to go backwards, meaning it is hard to make a case for Australian investors as either ignoring the technology sector or being antediluvian dunces oblivious to the upside computer stuff. And let's not forget that the world is not exactly flush with speculative cash at present.

The availability of this data won't stop startup-land putting out its hand for more. If only it could also show us a startup from the last five years worth a damn to justify its demands. And meanwhile the quiet achievers and job-creating wealth-builders of Australia's technology industries – that tier of professional services outfits and enterprise software houses with a few hundred employees - I'm thinking the likes of TechnologyOne, Kloud, Professional Advantage, Thomas Duryea – aren't cool enough for most media outlets to consider as exemplars of innovation or entrepreneurialism. They're not staffed by youths, following imported narratives about disruption, cloning Uber or re-inventing shopping. But plenty of them make money, grow and continuously improve their processes and products. But of course that's not innovation ... ®