This article is more than 1 year old

NBN Co reports fibre traction and Telstra action

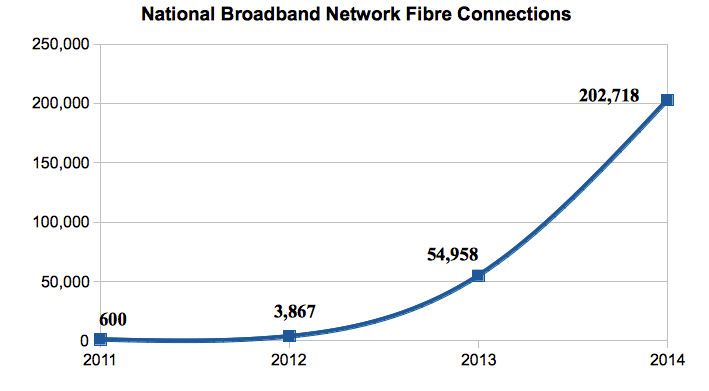

FTTP services breach the not-very-magical 200,000 barrier

NBN Co has made the slightly awkward announcement that it's more than tripled the number of premises connected to its fibre network in the past year, while maintaining its commitment to the multi-technology model for future rollouts.

It's chalked up the connections surge in spite of a management bonfire, several reviews to distract it, and the need to rework its designs to implement the politically-selected multi-technology model.

Since September 2013, when there were just shy of 55,000 connections to fibre, the network builder has added 147,760 active fibre services. That's driven an increase in revenue from AU$9m in Q1 2013 to $28 million in Q1 2014.

Average revenue per user (ARPU) has consolidated quite nicely as well, from $36 to $39, CFO Stephen Rue told the earnings call.

CEO Bill Morrow said he expects negotiations with Telstra (over access to the copper network, replacing the previous agreement that covered decommissioning the copper) to conclude before the end of the year, after which the two companies will take their proposed contract to the government and regulators for sign-off.

Morrow added that there is now an internal working group within NBN Co to work on agreements covering HFC networks owned by Telstra and Optus.

The numbers are in the results presentation here.

Morrow said the multi-technology model rollout – which really will go commercial from early in 2015 – is about going from “linear” growth to “exponential”, which prompted El Reg to pick through historical fibre connection data for the following chart.

Pssst, NBN Co: we found your missing exponential rollout acceleration

To accelerate the rollout, Morrow said, NBN Co would be “staying close to the developments” in fibre and copper technology, with an eye to “taking fibre to the most economic point … even if it's all the way up to the premises”. ®